| Source: Date: Updated: |

Chart of the Day

Thursday, April 4, 2013 Thursday, April 4, 2013 |

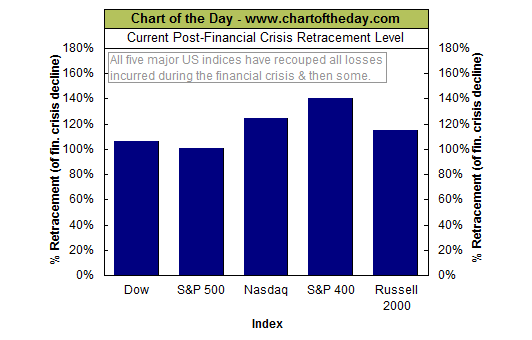

Last week’s chart illustrated how the US stock market (as measured by the S&P 500) has outperformed other major international stock markets since the financial crisis. For some further perspective on the post-financial crisis rally, today’s chart illustrates how much of the downturn that occurred as a result of the financial crisis has been retraced by each of the five major US stock market indexes. For example, the S&P 500 peaked at 1,565.15 back in October 9, 2007 and troughed at 676.53 back on March 9, 2009. The most recent close for the S&P 500 is 1,570.25 — it has retraced 100.6% of its financial crisis bear market decline. As today’s chart illustrates, each of these five major stock market indices has recouped all losses incurred during the financial crisis (i.e. all are above 100% on today’s chart). However, it has been the often overlooked S&P 400 (mid-cap stocks) that has been the star performer. The S&P 400 has recouped over 140% of its financial crisis decline — a very impressive performance.

Source: Chart of the Day